Instead of leaving your staff to handle time-consuming and cumbersome tasks, they can add more value to your organization by getting further training to take on supervisory and other decision-making roles. Cloud-Based Software Solutions – To benefit the most from artificial intelligence, you need a solution provider that can help you centralize your system, standardize it, and automate it. With all your financial data stored in the same place, you increase efficiency, share data effectively, and lower the risk of accounting errors significantly. When you outsource a team that leverages cloud solutions, you not only benefit from streamlined accounting processes but lower IT costs as it relieves you of the high costs of infrastructure and maintenance. Working from the cloud also results in the flexibility to scale your services to fit your unique needs because it is highly customizable.

Best Outsourced CFO Services For Startups

- More than just a delegation of tasks, it’s a strategic shift that frees up your time and resources, allowing you to refocus on the critical aspects of growing your business.

- Here at Personiv, we understand the ins and outs of outsourcing and what it takes to succeed in today’s growing accounting landscape.

- If you are using paper-based accounting information, you should switch to document management programs or accounting software that can categorize everything for you.

- Opting for outsourced finance and accounting services is an increasingly popular solution among business owners and growing startups.

Outsourcing is a tried and tested resourcing strategy that typically sees businesses identify repetitive and time-consuming tasks and assign them to third-party team members in another location. With many aspects of finance and accounting fitting the bill as transactional and/or rules-based, such jobs lend themselves to outsourcing and, in turn, ease the pressure on small and medium-sized businesses. Access to tax and wealth advisors can assist in building an efficient financial roadmap for your business. They can help you with individual tax planning, business continuity, disaster recovery and risk management, risk mitigation, and other aspects of financial planning.

How To Choose The Right Outsourced Service Provider

As you navigate the complexities of your startup’s financial landscape, remember that finance and accounting outsourcing is more than just a convenience. They’re a strategic tool that can significantly enhance your business efficiency and growth. Keeping track of deadlines, exemptions, deductions, credits, and life vs health insurance other tax-related matters can easily become a full-time job. Add in the amount of time required to stay up-to-date with the latest tax changes, and it’s no wonder entrepreneurs often dread tax season.

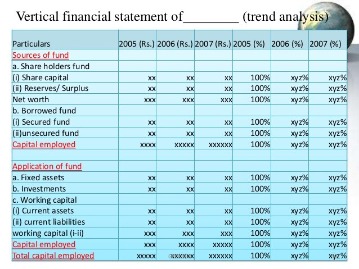

Ability to Provide Detailed Financial Reports – Investors and stakeholders will need to see performance reports to assess the financial health of the company. A great Finance as a Service provider is ready to provide detailed cash flow statements, income statements, balance sheets, financial statements of shareholders’ equity, and other relevant financial reports. The Finance as a Service provider must be able to achieve all this while maintaining compliance, particularly when it comes to taxes, audits, SEC reporting, and so on. With accurate finance and accounting records, you can decide how to reinvest in your company, evaluating cash on hand and anticipated costs that may impact cash flow. Whether you’re a startup aiming to minimize overhead costs or a seasoned enterprise seeking to focus on core competencies, outsourcing finance and accounting offers a myriad of benefits.

When you outsource, you can eliminate old-school manual accounting methods and replace them with automated and more streamlined workflows. If an organization wants to scale, it will need to ensure its current employees can keep up with the demands of expansion. However, if they are bogged down with tedious, manual tasks, there is little time and energy to train and develop their skills for growth.

How to Find a Great Finance as a Service Provider

This allows you to upgrade your operations without the high costs of buying and maintaining expensive accounting software and tools. Virtual and outsourced bookkeeping and accounting services are a happy medium between do-it-yourself software and pricey in-house bookkeeping. If that description fits what you’re looking for, one of the nine best virtual bookkeeping providers can save you time, money, and stress. But there’s more than one virtual accounting company in the world, and solutions range from on-demand CFO services to simple pay-by-the-hour book balancing. Below, we review the best virtual and outsourced accounting services for small-business owners like you. Therefore, the accounting service provider you outsource should be equipped with advanced tools and software that automate these tasks.

IBM’s modern approach to business process operations starts with an experiential co-creation approach that helps clients reimagine operational workflows infusing them with automation and AI. Bill to Cash BPO is a digital platform that helps businesses streamline their sales and billing processes, improving efficiency and customer satisfaction. RSM’s cloud-based FAO platform is easy, scalable and technologically powerful, providing real-time information in dashboard format for clear decision-making. Even if you have the numbers, not being able to interpret and understand them also calls for an outsourced financial backup to ensure that your business is heading in the right direction. Therefore, outsourcing cuts much of the cost that comes with having an in-house team independent variable definition and examples but still allows you to work with the best professionals in the F&A industry.

Fractional CFO Services

In the end, the decision to outsource is specific to each startup and dependent on your unique needs and ambitions. Also, look into quality and industry knowledge, business intelligence, and their ability to leverage and manage technology-based solutions effectively. The implementation of best-in-class systems and processes fast-tracks your organization towards growth and innovation. Only the best systems, processes, and controls can gain insight into your financial performance and health to eliminate silos, fill gaps, and improve productivity. They should also be able to guarantee internal controls for risk mitigation and data security.

An outsourced CFO brings an arsenal of high-level financial acumen, offering insights into cash flow management, financial forecasting, risk mitigation, budgeting, and investment strategies. This role is exceptionally significant during pivotal phases such as fundraising rounds, market expansion, financial restructuring, or the significant reduction of operating expenses. If you’ve ever nixed the idea of outsourced accounting from your list of potential strategies, you’re not alone. Most small-to-mid-size companies consider outsourcing to be an unattainable resource reserved only for global-size businesses.

Bookkeeper.com manages auditing standard no 13 your accounts using QuickBooks Online (or QuickBooks Desktop, if you prefer). Plus, not every online bookkeeping service works with both accrual-basis and cash-basis accounting—but Bookkeeper.com does. If your company has never utilized outsourcing as a resource before, you may have some questions that give you pause. Better yet, you may wonder why you should outsource your finance tasks rather than taking the traditional in-house approach. Read the full guide to explore why outsourced accounting has surpassed other methods and how choosing the right virtual accounting partner is key to the growth of your organization.