Whether you’re a seasoned pro or a newcomer to the world of investing, grasping the essentials of the Current Ratio is a critical step toward financial acumen. In actual practice, the current ratio tends to vary by the type and nature of the business. Everything is relative in the financial world, and there are no absolute norms. The current ratio is a rough indicator of the degree of safety with which short-term credit may be extended to the business. On the other hand, the current liabilities are those that must be paid within the current year. Suppose we’re tasked with analyzing the liquidity of a company with the following balance sheet data in Year 1.

Formula For Current Ratio

In the text below, we will explain to you what is a current ratio. A ratio greater than 1 means that the company has sufficient current assets to pay off short-term liabilities. In some cases, companies may attempt to improve their Current Ratio by delaying payments or accelerating the collection of accounts receivable. Analysts must be vigilant for such tactics, which can distort the true financial health of a company.

Why You Can Trust Finance Strategists

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. From Year 1 to Year 4, the current ratio increases from 1.0x to 1.5x. The best long-term investments manage their cash effectively, meaning they keep the right amount of cash on hand for the needs of the business.

- Book a demo today to see what running your business is like with Bench.

- The volume and frequency of trading activities have high impact on the entities’ working capital position and hence on their current ratio number.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

- Clearly, the company’s operations are becoming more efficient, as implied by the increasing cash balance and marketable securities (i.e. highly liquid, short-term investments), accounts receivable, and inventory.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

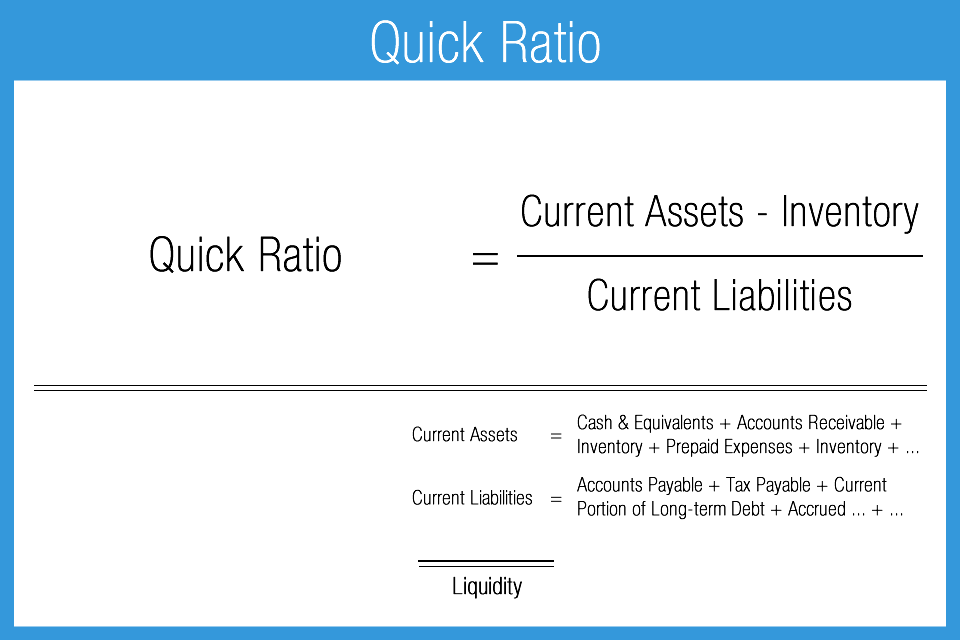

Current Ratio vs. Other Liquidity Ratios

Current assets like cash, cash equivalents, and marketable securities can easily be converted into cash in the short term. This means that companies with larger amounts of current assets will more easily be able to pay off current liabilities when they become due without having to sell off long-term, revenue generating assets. Other similar liquidity ratios can supplement a current ratio analysis. In each case, the differences in these measures can help an investor understand the current status of the company’s assets and liabilities from different angles, as well as how those accounts are changing over time. The current ratio is calculated simply by dividing current assets by current liabilities.

What is the approximate value of your cash savings and other investments?

So a current ratio of 4 would mean that the company has 4 times more current assets than current liabilities. With both values in hand, one can proceed to calculate the current ratio by dividing the total current assets by the total current liabilities. The current ratio equation free xero course is a crucial financial metric, that assesses a company’s short-term liquidity by comparing its current assets to its current liabilities. A ratio above 1 indicates the company can meet its short-term obligations, while below 1 suggests potential liquidity issues.

When you do that, you see that liquidity ratios are based on a borrower’s ability to pay off its short-term (or current) debt with its current assets. The above analysis reveals that the two companies might actually have different liquidity positions even if both have the same current ratio number. While determining a company’s real short-term debt paying ability, an analyst should therefore not only focus on the current ratio figure but also consider the composition of current assets.

If a company has $500,000 in current assets and $250,000 in current liabilities, its Current Ratio is 2 ($500,000 / $250,000), indicating that it has twice the assets to cover its immediate obligations. However, an examination of the composition of current assets reveals that the total cash and debtors of Company X account for merely one-third of the total current assets. Clearly, the company’s operations are becoming more efficient, as implied by the increasing cash balance and marketable securities (i.e. highly liquid, short-term investments), accounts receivable, and inventory. Companies may use days sales outstanding to better understand how long it takes for a company to collect payments after credit sales have been made. While the current ratio looks at the liquidity of the company overall, the days sales outstanding metric calculates liquidity specifically to how well a company collects outstanding accounts receivables.

It’s calculated by dividing current assets by current liabilities. The higher the result, the stronger the financial position of the company. Working Capital is the difference between current assets and current liabilities. A business’ liquidity is determined by the level of cash, marketable securities, Accounts Receivable, and other liquid assets that are easily converted into cash. The more liquid a company’s balance sheet is, the greater its Working Capital (and therefore its ability to maneuver in times of crisis).

Instead, there is a clear pattern of seasonality in current ratio equations. The available research on day trading suggests that most active traders lose money. You can learn how my students and I have become successful trading penny stocks in my Trading Challenge.

If it needs cash badly, a sketchy company may pump its stock up, then rip your heart out with a toxic offering. When you’re in an overnight position after the market closes, you’re stuck. But sometimes I trade overnight plays that force me to be patient. When I plan to hold overnight, I tend to check more fundamentals. I may look at ratios and dig into SEC filings to figure out how bad the company needs cash. Its simple to calculate, which makes it attractive to traders and investors.