Moreover, accountants can develop accurate audit reports, financial statements, and other accounting documentation required by government regulation and lending institutions. Whether it’s planning for retirement or estate planning, a personal accountant assists in mapping out long-term financial strategies. Managing personal finances can be time-consuming and stressful, especially for those unfamiliar with financial management.

Accounting Software Options

While the CPA fee schedule has the potential to cost more than one of these options, you may find that you save more on your taxes by entrusting them to a certified public accountant. As a small business owner, chances are you’re filling every role within your company, so hiring an accountant might be last on your list of priorities. But staying on top of your financial information can be time-consuming, and long-term financial forecasting requires a certain level of expertise. Accurate accounting records help you maximize your tax deductions, track money coming in and out, and plan for the future. While larger companies may be able to afford salaried accountants on their payroll, not every business has that luxury.

- To verify that someone is a certified public accountant that can help your company with its finances, go to the CPA verification page.

- Some offer personal financial planning services, human resources or technology consulting, startup assistance, estate planning advice, and more.

- They estimate the average cost for professional tax preparation as ranging between $152 to $261 depending upon the complexity of your taxes and whether you have additional forms beyond the 1040 to prepare.

- In most cases, it’s a good idea to work with an individual small business CPA or company with a presence in the state where you do the most business.

- Many CPA firms also package advisory services with traditional tax and accounting services for a set monthly or annual fee.

- There is a “good, better, best” mentality when an accountant presents the choices and explains how much an accountant costs for each scenario.

Option 2. Tax preparers

However, only a handful of states don’t have state taxes, so you’ll likely need that additional form at the state level. In most cases, it’s a good idea to work with an individual small business CPA or company with a presence in the state where you do the most business. They know the lay of the land best and can identify state-specific ways to lower your tax bill. Much like rental and vendor costs, the location of your CPA can affect price. Someone based in a high-cost area such as California or New York typically charges more than someone in Nebraska or Delaware.

Hire a Professional or Do It Yourself?

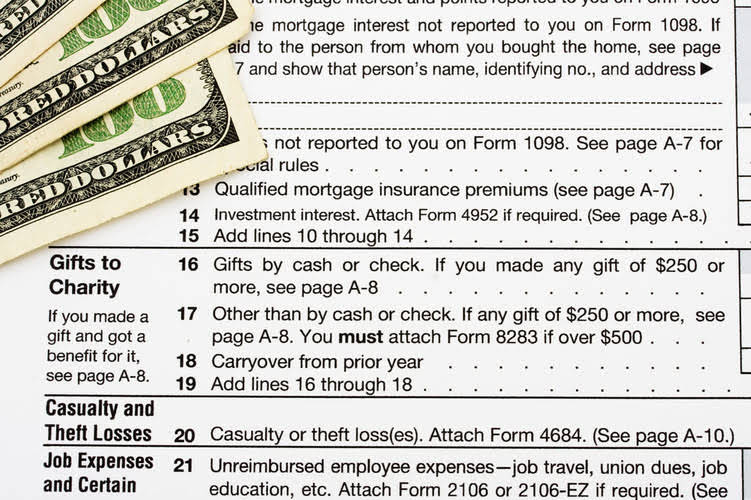

The cost of hiring a CPA also increases the more complicated your return is and the more time that person has to spend on it. The same study from the NSA found if you are self-employed and need to hire a CPA to prepare an itemized Form 1040 with a Schedule C and a state tax return form, the average fee increases to $515. A personal accountant offers advice on budgeting and savings and guides you in creating effective investment strategies. With their help, you can make informed financial decisions that promote wealth accumulation. In this article, we’ll explain how accountants calculate their costs and the average cost of an accountant to help you decide if hiring an accountant is the right decision for your business. When you get to this stage, you might wonder how to outsource these https://www.bookstime.com/ tasks to someone with more expertise—like an accountant.

An accountant will prepare your tax returns to make sure you’ve minimized your tax liability. They can even represent you before the IRS in the rare case that you’re audited. The National Society of Accountants reports that the average rate for management advisory services is $158 per hour. Many CPA firms also package advisory services with traditional tax and accounting services for a set monthly or annual fee. You can work with personal accountant a bookkeeper to help you get started with your personal accounting.

Pay your team

With their expertise, they can identify potential tax deductions and credits, minimizing your tax liability. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

- Tax accountants tend to be pricier than other preparers because of their level of experience and education, but depending on your needs, another type of pro can also do the job.

- Your financial projections can help convince potential investors of your business’s growth potential.

- After all, you want to make sure you’re on the same page with the person who is going to handle your personal financial documents.

- By understanding these various factors, clients can make an informed decision when selecting an accountant that meets their specific needs and budget constraints.

- Asking a few questions can also help you to gauge if the CPA is the right person for the job.

Additionally, some software offer mileage tracking and time tracking features, enabling businesses to monitor employee productivity and accurately charge clients for services rendered. Small businesses can expect to pay an average of $1,000 to recording transactions $5,000 annually for accounting services, according to Business News Daily. However, fees may vary depending on the size of the business, the complexity of the financial situation, and the services provided.

Prepare and file business taxes

They operate on an in-depth understanding of their client’s financial situations, goals, and concerns, enabling them to provide personalized advice and strategic financial solutions. Tax planning, on the other hand, is a proactive approach aimed at minimizing tax liabilities while remaining in compliance with tax laws. This process involves staying informed about tax regulations and making strategic decisions to legally reduce the amount of owed taxes.