Calculating and managing direct labor efficiency variance is essential for controlling labor costs in the construction industry. We’ll also show the formula used to calculate it and the factors that affect its calculation. By the end, you’ll be able to understand how this measurement can improve your project’s labor costs, which means that it will ensure a more profitable outcome.

Products

By implementing these best practices, companies can effectively manage labor variances, reduce costs, and improve productivity. Focusing on both labor rate and labor efficiency variances ensures a comprehensive approach to labor cost management, leading steps for reconciling irs form 941 to payroll to better financial performance and operational success. Analyzing labor variances is critical for effective cost management and operational efficiency. It provides insights into how well a company controls its labor costs and utilizes its workforce.

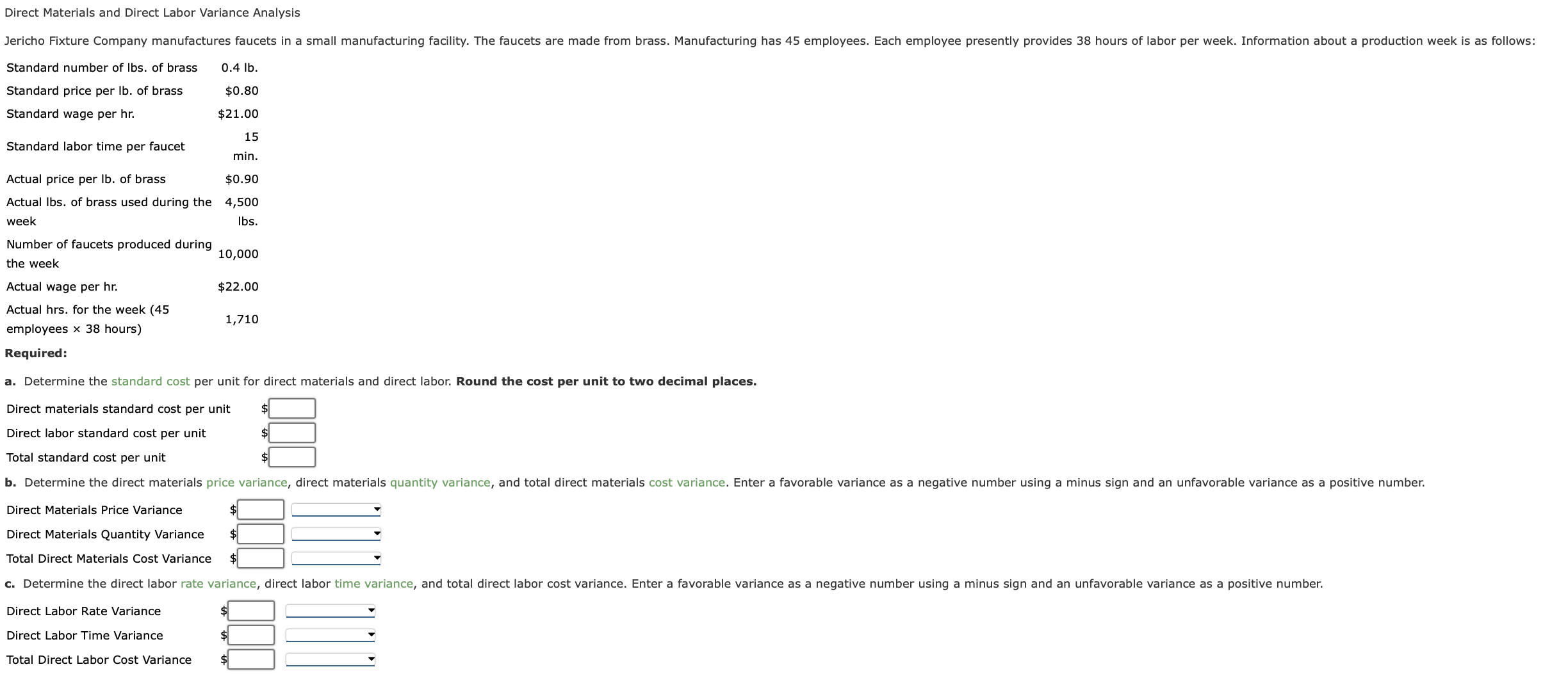

Direct Labor: Standard Cost, Rate Variance, Efficiency Variance

Kenneth W. Boyd has 30 years of experience in accounting and financial services. He is a four-time Dummies book author, a blogger, and a video host on accounting and finance topics. Average acceleration is the object’s change in speed for a specific given time period. The more Direct Labor Mix Variance is decreased, the less wasted resources are on production, and the better chance there is that products will be produced within their optimal amount of time. With real-time visibility, construction managers can make data-driven decisions that reduce labor inefficiencies and improve project timelines.

Who is Responsible for the Labor Rate Variance?

This variance helps businesses understand whether their workforce is working more or fewer hours than expected to produce a given level of output. If the total actual cost is higher than the total standard cost, the variance is unfavorable since the company paid more than what it expected to pay. By applying these lessons, companies can better manage their labor costs, improve productivity, and achieve greater financial control and stability. These case studies highlight the importance of regular variance analysis and proactive management in addressing labor-related challenges.

It measures the difference between the actual labor costs incurred during production and the standard labor costs that were expected or budgeted. This variance can provide valuable insights into how well a company is managing its workforce and whether labor costs are being controlled effectively. Direct labor efficiency variance is a financial metric that takes the standard labor hours estimated during the planning phase of a project and compares them with the actual direct labor hours that have been used.

What is the difference between labor yield and mix variances?

- Dan advises clients on strategic planning, federal and state tax issues, transactional matters, and employee benefits.

- As with direct materials, the price and quantity variances add up to the total direct labor variance.

- For example, advanced tools like SmartBarrel’s workforce management solutions provide real-time insights into labor usage on the construction site.

- Additionally, it is important to ensure that labor costs are monitored and managed effectively.

- Find the direct labor rate variance of Bright Company for the month of June.

He has taught accounting at the college level for 17 years and runs the Accountinator website at , which gives practical accounting advice to entrepreneurs. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Mark P. Holtzman, PhD, CPA, is Chair of the Department of Accounting and Taxation at Seton Hall University.

An overview of these two types of labor efficiency variance is given below. Let’s say our accounting records show that the line workers put in a total of 2,325 hours during the month. The most common cause of Direct Labor Mix Variance is a change in the staffing requirements for a particular job, such as the introduction of a new type of worker or skill. Other potential causes include changes in technology, raw material costs, and production processes. Direct Labor Mix Variance is defined as the difference between the exact amount of labor needed to manufacture a product and the actual amount of labor used for that product. Note that in contrast to direct labor, indirect labor consists of work that is not directly related to transforming the materials into finished goods.

SmartBarrel makes 100% accurate time tracking stupid simple — saving you hours every week, keeping your job costs on track, and eliminating all payroll disputes. Direct Labor Mix Variance is typically calculated by subtracting the actual amount of labor used from the budgeted amount, then dividing the result by the budgeted amount. Direct Labor Mix Variance typically occurs when the actual labor mix used in production is different from what was budgeted or anticipated.